Some of them are on auto-pay and are withdrawn from your bank account on the same day every month. If you have multiple credit cards, you might want to give each a nickname – Chase, Disc., Cap1, etc.Īs you get older, it seems like you acquire more and more bills. For this, I included space to write in the date, the purchase/place of purchase, the amount spent, and what purchase method was used. Fill out the beginning balances on the first of the month and the ending balances on the last day of the month.Īlong with the bill tracker and balances, I have also included space for payday information and extra necessary expenses like gas, food, school-related expenses, etc.īelow the bills and expenses section is the beginning of the spending log.

Off to the righthand side of the page, there is space for your beginning and ending monthly balances of both your checking and savings accounts. If you needed more room, you could recreate this spread without the spending log at the bottom. There is enough room on this template for 17 different monthly bills.

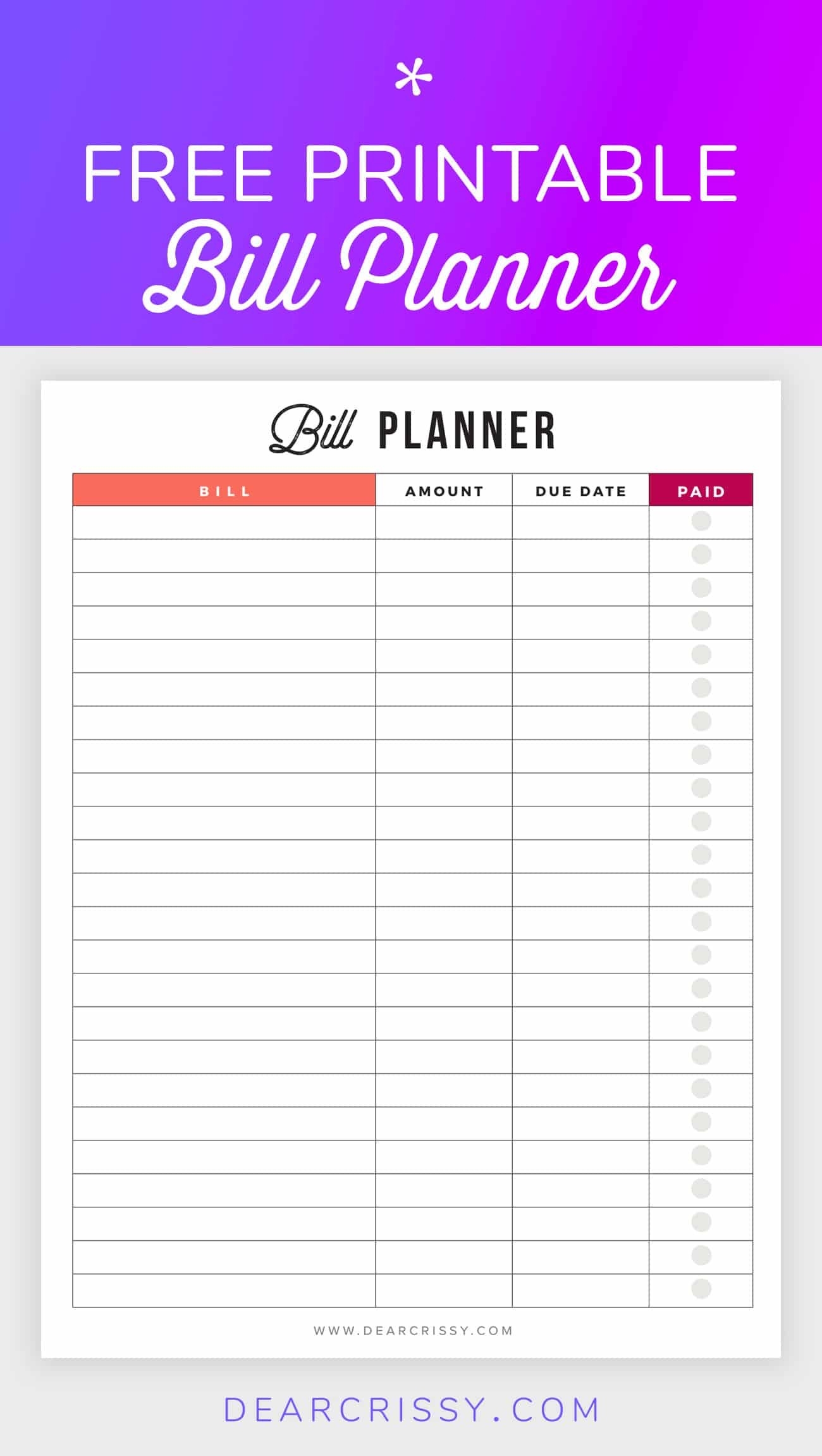

It has space for each of your monthly bills, along with the due date, if your bill is on auto-pay, and a place to mark off when the said bill has been paid. This page is your standard budget planner page. Whether you are setting financial goals, fitness goals, or work-related goals, you should be writing them down and looking at them often. On top of that, when you write down your goals, you can easily reference them. In short, this means that you are more likely to remember your goals. According to this Forbes article, a process known as encoding happens when you write down your goals. Writing down your goals plays a huge role in helping you accomplish them. Further, break that down by paycheck to figure out how much you should be saving out of each paycheck. Here you will write in the steps you need to take to achieve your goals.įor instance, if you wanted to save $1000 in 10 months, you would need to be saving $100 per month. Put $50 from each paycheck this month into a savings accountīelow the area where you will write in your actual goals is a place to fill out your action plan.Don’t spend any money on clothing this month.Spend less than $100 eating out or ordering food this month.Save receipts from every purchase throughout the month of November.Here are a few monthly financial goal ideas: Maybe you want to have two separate goal pages one is for monthly goals, and one is for annual financial goals. You can set both short and long-term goals on this page as long as you specify your timeframe. Some examples of SMART financial goals might be: pay of Chase credit card by Christmas this year or have $1000 in our joint savings account by June 2019.

PRINTABLE BUDGET CALENDAR HOW TO

If you are unsure how to write out your goals efficiently, check out this post on Goal Setting Strategies. On this page, you will write out three of your top financial goals and the timeframe in which you wish to accomplish them.

PRINTABLE BUDGET CALENDAR FREE

But, you are free to use these in whatever way works best for you. While most of the pages in this setup are fairly self-explanatory, I want to explain and show you how I use them most efficiently. Bullet Journal Budget Pages to Help Manage Money and Stress The printable bullet journal budget pages below can be used time and time again and will help you better manage your money, debt, and savings goals. These bullet journal budget pages were created to help make budgeting and financial planning easier and less stressful.

PRINTABLE BUDGET CALENDAR FULL

So, I took two full days to come up with pages that were beneficial for this purpose. I know that the best way for me to do this is with my bullet journal. That’s why I decided that we needed a budget and something that would hold us accountable. But, when we haven’t taken the time to sit down and write out a budget and plan for that kind of large purchase, it’s unrealistic. So, we know that we need to be saving for a down payment. More than anything, we both want to buy a house. But, we often find ourselves living paycheck to paycheck because in the past we have not budgeted our money. My husband and I make enough money every month to pay our bills, buy our expenses, and still have money for little luxuries. Trying to figure out how to manage all of that is stressful. You have bills that have to be paid, food that needs to be bought, and gas to put in your car. Whether you are trying to save for a big purchase like a home or trying to pay off student loans, budgeting your money can be difficult and seem overwhelming. Please see my Disclosure for more information. Looking to create a budget? Want to have emergency savings? Or do you want to pay off a debt? Start with this post. Check out these top tips and bullet journal budget printables to take control of your finances.

0 kommentar(er)

0 kommentar(er)